Taxes in the UAE

At Finlogix there is a nurturing culture that is caring and protecting of its staff alongside an environment where they can develop and flourish. This ethos is also reflected in the way that we work with clients, taking time to understand their business and investing in the relationship to ensure that we can provide the best possible advice.

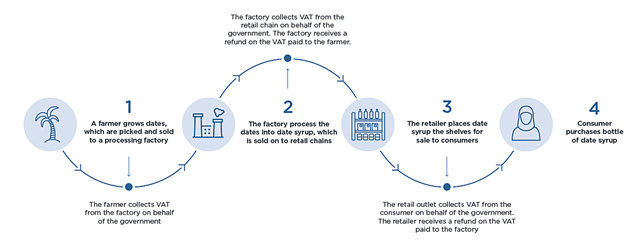

VAT is charged at each step of the 'supply chain'. End consumers generally bear the VAT cost while registered businesses collect and account for the tax, in a way acting as a tax collector on behalf of the Federal Tax Authority.

Only VAT registered businesses will need to charge and account for VAT; please refer to the registration section to understand your registration obligations under the UAE VAT law.

The below illustration demonstrates how VAT works throughout the supply chain:

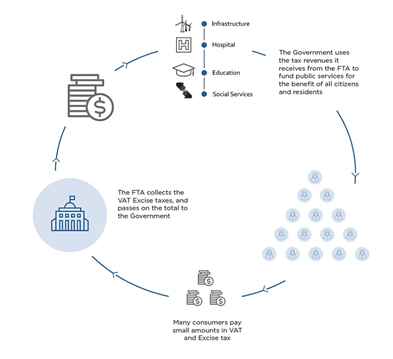

Excise Tax is a form of indirect tax levied on specific goods. These goods are typically those that are harmful to human health or the environment. The intent of the tax is to reduce consumption of these commodities while also raising revenues for the government that can be spent on beneficial public services.

In the UAE, Excise Tax will apply to the following goods:

- Tobacco products

- Carbonated drinks (note that this excludes sparkling water)

- Energy drinks

End consumers of these products will generally pay a higher retail price once Excise Tax is implemented.

All businesses that import, produce or store excisable goods must consider if they must be registered with the Federal Tax Authority and are accountable for filing and paying Excise Tax.

The introduction of taxes in the UAE is part of a GCC-wide initiative to diversify regional economies. Given the overall reduction in oil prices in recent years, it has been necessary for the GCC member states to explore other revenue raising measures and reduce dependency on hydrocarbons as the key contributor to the public purse. As a result, the GCC member states have agreed to sign unified framework agreements for the implementation of VAT and Excise taxes. Member states will also implement their own domestic legislation that will govern the introduction of these taxes.

The UAE’s citizens and residents enjoy exceptional public services, such as healthcare, roads, education, parks, social services and waste management. The full cost of these services is paid for by the government. The introduction of VAT and Excise taxes will help the UAE diversify sources of revenue so that government departments can continue to deliver excellent public services and ensure a high quality of life for coming generations.

In addition, taxation allows governments to correct certain behaviors that are detrimental to society and which cannot be left to the market to regulate. Excise taxes on products that are harmful to human health are a good example of this.